Why Choose a Local Mortgage Broker Glendale CA for Personalized Service

The Comprehensive Function of a Home Mortgage Broker in Securing the very best Loan Choices and Prices for Your Home Acquisition

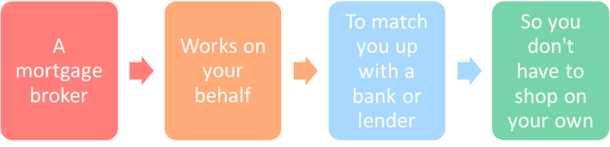

A home mortgage broker works as a crucial intermediary in the home acquiring process, connecting purchasers with a variety of lenders to safeguard optimum funding options and rates. By reviewing individual monetary circumstances and leveraging market understandings, brokers are well-positioned to bargain favorable terms and improve the commonly intricate lending application process. This competence not just conserves time yet additionally boosts the likelihood of obtaining advantageous financing. Yet, understanding the full extent of a mortgage broker's capabilities can considerably affect your home-buying experience. What factors should you consider when picking the appropriate broker for your demands?

Comprehending the Mortgage Broker's Duty

Home loan brokers frequently work as intermediaries in between debtors and lenders, facilitating the financing purchase procedure. Their main responsibility is to examine the financial requirements of customers and match them with appropriate home mortgage products from a series of loan provider. Mortgage Broker Glendale CA. This needs a thorough understanding of the home loan landscape, consisting of various financing types, rate of interest, and loan provider needs

Brokers begin by collecting essential monetary info from customers, such as income, debt history, and existing financial debts. This data is vital for identifying one of the most appropriate financing options available. When the essential information is gathered, brokers carry out detailed market research to determine lenders that align with the consumer's requirements, typically leveraging established relationships with numerous banks to secure competitive terms.

In addition, mortgage brokers provide assistance throughout the entire funding application procedure. They help customers in finishing paperwork, making sure conformity with lending institution needs, and using suggestions on boosting credit reliability if required. By working as a bridge between customers and loan providers, mortgage brokers streamline the often-complex procedure of safeguarding a home loan, eventually saving customers effort and time while boosting the probability of protecting favorable lending terms.

Benefits of Making Use Of a Home Loan Broker

In addition, mortgage brokers have access to a large selection of lending organizations, which enables them to existing borrowers with a huge selection of alternatives that they might not locate independently. This access can lead to a lot more affordable prices and terms, inevitably saving debtors cash over the life of the financing.

Another advantage is the time-saving aspect of collaborating with a broker. They deal with the complicated documents and settlements, enhancing the application procedure and minimizing the problem on debtors. Furthermore, brokers can use individualized assistance and recommendations throughout the financing journey, fostering a sense of self-confidence and clarity.

Just How Home Loan Brokers Contrast Lenders

Brokers play an essential role in contrasting lenders to recognize one of the most suitable choices for their customers. They possess considerable understanding of the home mortgage market, including numerous lenders' items, rates, and terms - Mortgage Broker Glendale CA. This expertise enables them to perform extensive analyses of the available finance options based on the one-of-a-kind financial scenarios and choices of their clients

Home loan brokers use specialized databases and tools to collect current information on several lending institutions successfully. They evaluate crucial variables such as interest rates, car loan costs, settlement terms, and eligibility requirements. By comparing these aspects, brokers can highlight the advantages and disadvantages of each alternative, guaranteeing their clients make informed decisions.

Additionally, brokers preserve connections with a varied variety of lending institutions, consisting of typical financial institutions, cooperative credit union, and alternate funding resources. This network enables them access to special offers and potentially much better terms that may not be offered directly to consumers.

Ultimately, a mortgage broker's ability to contrast lending institutions encourages customers to protect competitive prices and positive funding problems, improving the process of finding the right home mortgage remedy customized to their private needs.

The Car Loan Application Process

Browsing the finance application procedure is a vital step for customers looking for to protect financing for their homes. This procedure normally begins with the collection of necessary documents, consisting of income confirmation, credit records, and possession statements. A home mortgage broker plays an important role below, directing customers with the paperwork and making certain all info is full and accurate.

As soon my explanation as the paperwork is collected, the broker submits the lending application to numerous loan providers, facilitating an affordable atmosphere that can cause better rates and terms. They likewise aid clients recognize different lending alternatives, such as fixed-rate, adjustable-rate, or government-backed car loans, ensuring the selected item aligns with their monetary scenario.

Throughout the underwriting process, which involves lenders assessing the debtor's credit reliability and the building's worth, the broker acts as an intermediary. By leveraging their proficiency and industry relationships, mortgage brokers enhance the likelihood of a successful discover this lending application, enabling clients to relocate more detailed to homeownership with self-confidence.

Tips for Picking the Right Broker

Picking the right home loan broker can dramatically impact the general loan experience and result for customers. To ensure a successful collaboration, take into consideration the following ideas when picking a broker.

First, evaluate their experience and credibility within the market. Seek brokers with a proven track record in safeguarding desirable lending terms for clients with differing economic profiles. Mortgage Broker Glendale CA. Checking out evaluations and looking for references from relied on resources can provide important insights

Second, examine their array of lending institution links. A broker with accessibility to numerous lenders will be better placed to offer diverse lending options and competitive rates, ensuring you find the very best fit for your demands.

Third, inquire about their interaction design and schedule. A receptive broker that focuses on client communication can help reduce stress throughout the lending process.

Lastly, ensure they are clear regarding their charges and compensation structure. A reliable broker will certainly supply a clear malfunction of expenses upfront, helping you stay clear of unforeseen expenditures later.

Final Thought

By leveraging market knowledge and working out positive terms, brokers boost the chance of securing optimal funding alternatives and prices. Picking the appropriate home mortgage broker can lead to a more efficient and successful home purchasing experience, ultimately contributing to informed financial decision-making.

A mortgage broker offers as a vital intermediary in the home acquiring procedure, attaching customers with an array of loan providers to protect ideal funding choices and rates.Mortgage brokers frequently act as middlemans in between consumers and useful content lending institutions, helping with the car loan acquisition process.Additionally, mortgage brokers give advice throughout the whole car loan application process. By offering as a bridge in between customers and lenders, home loan brokers streamline the often-complex procedure of protecting a mortgage, inevitably saving clients time and initiative while enhancing the likelihood of safeguarding beneficial lending terms.

By leveraging their expertise and sector relationships, home mortgage brokers improve the likelihood of an effective lending application, making it possible for clients to relocate better to homeownership with self-confidence.